Time Series Analysis on Stock Market Data— Explained

Time series analysis is a specific way of analyzing a sequence of data points collected over an interval of time. In time series analysis, analysts record data points at consistent intervals over a set period of time rather than just recording the data points intermittently or randomly.

Components of Time Series

- Trend: In which there is no fixed interval and any divergence within the given dataset is a continuous timeline. The trend would be Negative or Positive or Null Trend

- Seasonality: In which regular or fixed interval shifts within the dataset in a continuous timeline. Would be bell curve or saw tooth

- Cyclical: In which there is no fixed interval, uncertainty in movement and its pattern

- Irregularity: Unexpected situations/events/scenarios and spikes in a short time span.

Types of Time Series

Stationary: A dataset should follow the below thumb rules without having Trend, Seasonality, Cyclical, and Irregularity components of the time series.

Non- Stationary: If either the mean-variance or covariance is changing with respect to time, the dataset is called non-stationary.

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

import seaborn as sns

import statsmodels.api as sm

from statsmodels.tsa.seasonal import seasonal_decompose

from statsmodels.tsa.stattools import adfuller

from statsmodels.tsa.stattools import kpss

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

from statsmodels.tsa.ar_model import AutoReg

from statsmodels.tsa.arima.model import ARIMA

from pandas_datareader import data as pdr

import yfinance as yf

from sklearn.metrics import mean_squared_error

yf.pdr_override()

sns.set_style("whitegrid")

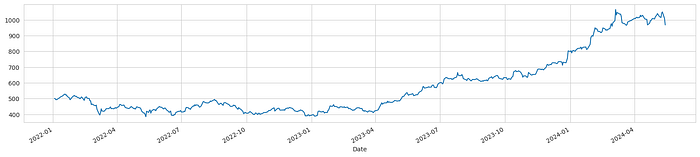

plt.rcParams['figure.figsize'] = (20,6)df = pdr.get_data_yahoo('TATAMOTORS.ns')

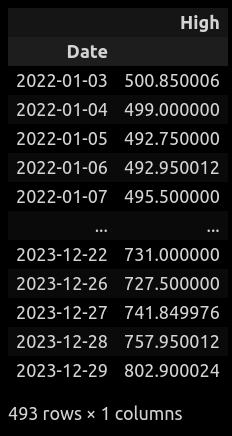

df.tail()# cuf-off some data

df = df.loc['2022-01-01':,:]

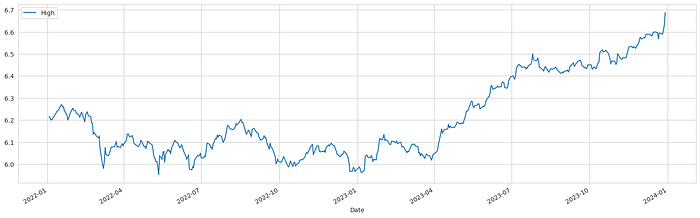

df = df['High']df.plot(figsize=(20,4))

df = df.reset_index()df['Date'] = pd.to_datetime(df['Date'])

df = df.set_index(keys='Date'df

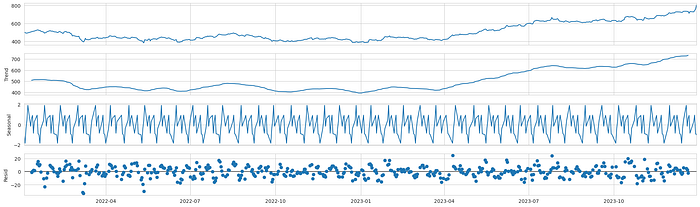

sd = seasonal_decompose(df,model='additive',period=12).plot()

df_log = np.log(df)

df_log.plot()

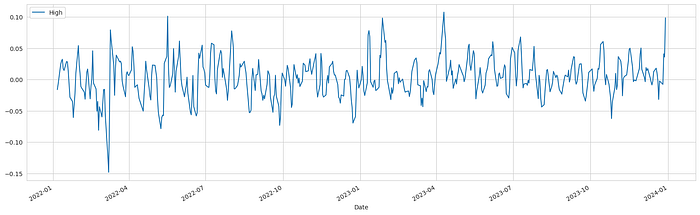

df_log_diff = df_log.diff(periods=3)

df_log_diff.dropna(inplace=True)

df_log_diff.plot()

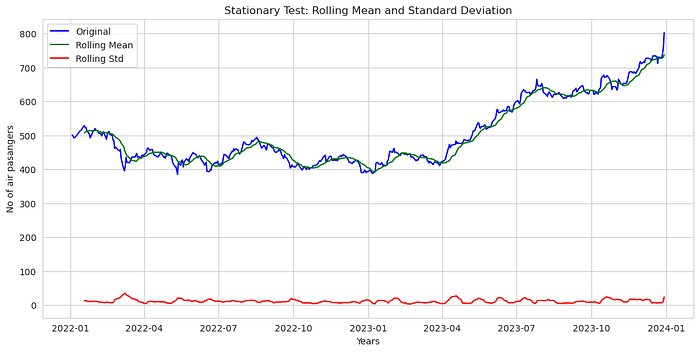

def stationarity_test(df):

df.dropna(inplace=True)

rolling_mean = df.rolling(window=12).mean()

rolling_std = df.rolling(window=12).std()

#plotting all rolling mean and std

plt.figure(figsize = (13,6))

plt.xlabel('Years')

plt.ylabel('No of air pasangers')

plt.title('Stationary Test: Rolling Mean and Standard Deviation')

plt.plot(df, color= 'blue', label= 'Original')

plt.plot(rolling_mean, color= 'green', label= 'Rolling Mean')

plt.plot(rolling_std, color= 'red', label= 'Rolling Std')

plt.legend()

plt.show()

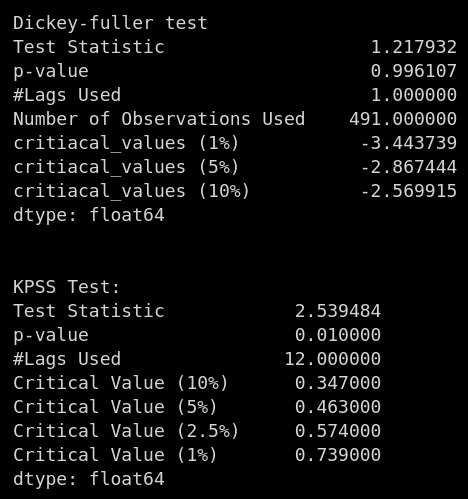

# Dickey - fuller test for statonarity

print('Dickey-fuller test')

df_test = adfuller(df)

df_op = pd.Series(data = df_test[0:4],index = ['Test Statistic', 'p-value', '#Lags Used', 'Number of Observations Used'])

for key,value in df_test[4].items():

df_op['critiacal_values (%s)'%key] = value

print(df_op)

print ('\n\nKPSS Test:')

kpsstest = kpss(df, regression='c', nlags="auto")

kpss_output = pd.Series(kpsstest[0:3], index=['Test Statistic','p-value','#Lags Used'])

for key,value in kpsstest[3].items():

kpss_output['Critical Value (%s)'%key] = value

print (kpss_output)stationarity_test(df)

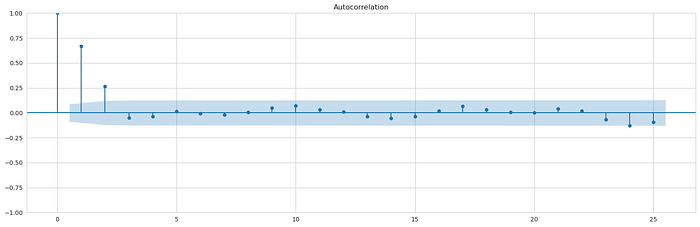

plot_acf(df_log_diff, lags = 25);

print()

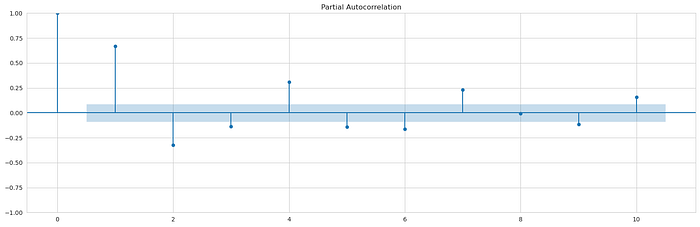

plot_pacf(df_log_diff, lags = 10);

print()

train_size = int(len(df_log_diff) * 0.8)

train, test = df_log_diff[:train_size], df_log_diff[train_size:]# Function to plot actual vs predicted values

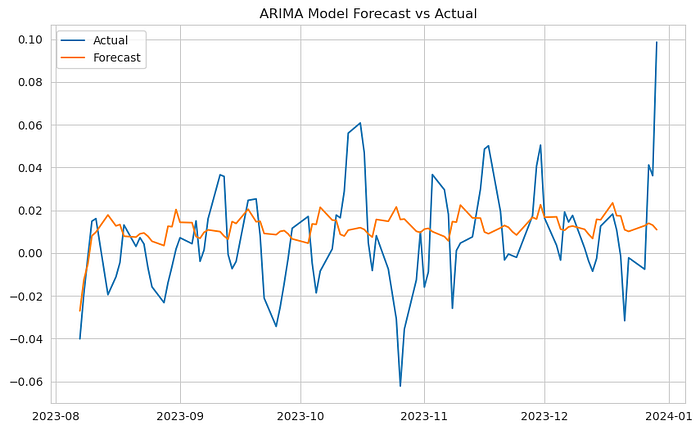

def plot_forecast(test, forecast, model_name):

plt.figure(figsize=(10, 6))

plt.plot(test.index, test, label='Actual')

plt.plot(test.index, forecast, label='Forecast')

plt.title(f"{model_name} Forecast vs Actual")

plt.legend()

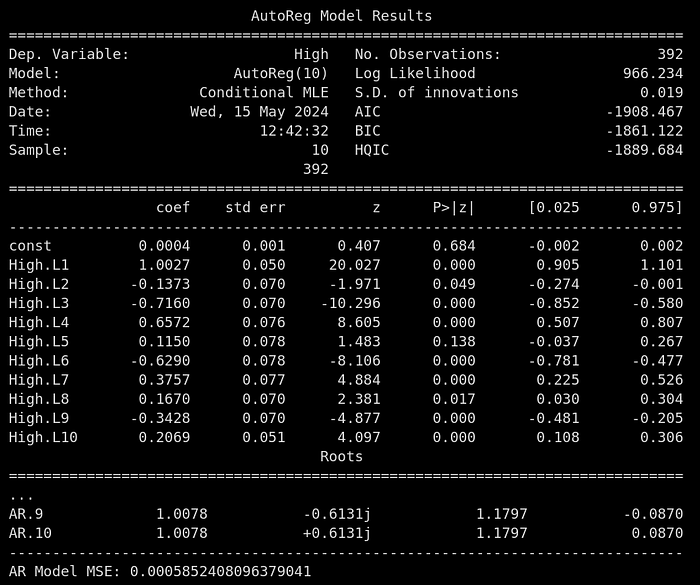

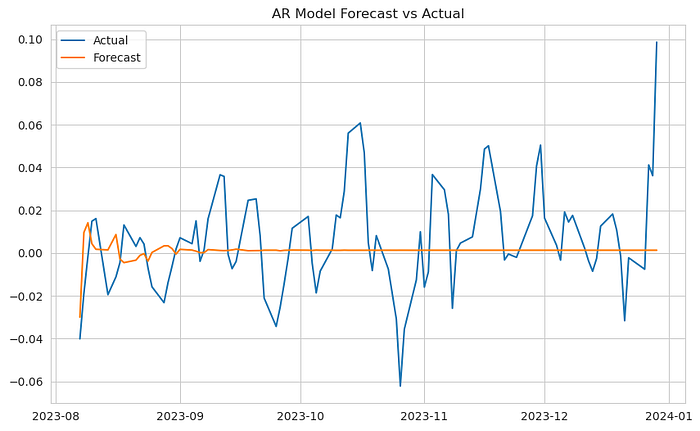

plt.show()ar_model = AutoReg(train.dropna(), lags=10).fit()

ar_forecast = ar_model.predict(start=len(train), end=len(train)+len(test)-1)

print(ar_model.summary())

print('AR Model MSE:', mean_squared_error(test, ar_forecast))

plot_forecast(test, ar_forecast, 'AR Model')

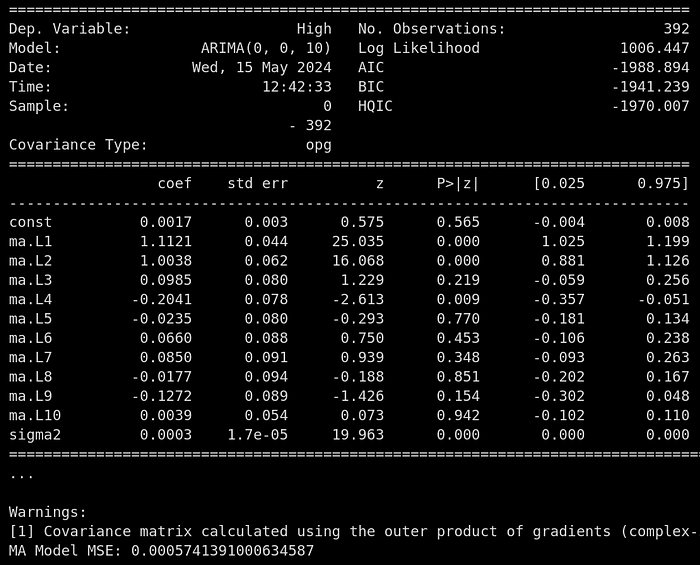

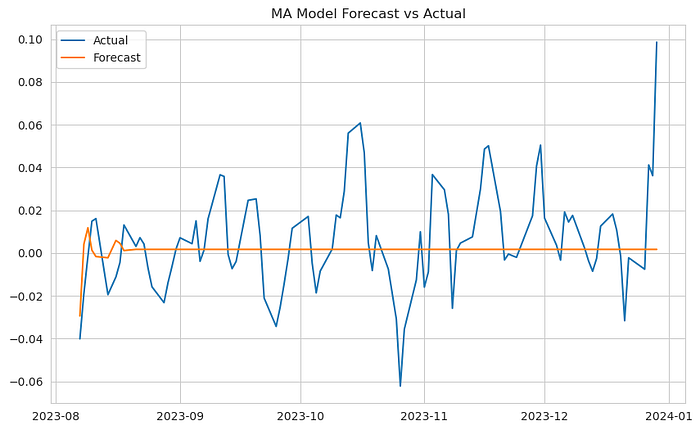

ma_model = ARIMA(train.dropna(), order=(0,0,10)).fit()

ma_forecast = ma_model.predict(start=len(train), end=len(train)+len(test)-1)

print(ma_model.summary())

print('MA Model MSE:', mean_squared_error(test, ma_forecast))

plot_forecast(test, ma_forecast, 'MA Model')

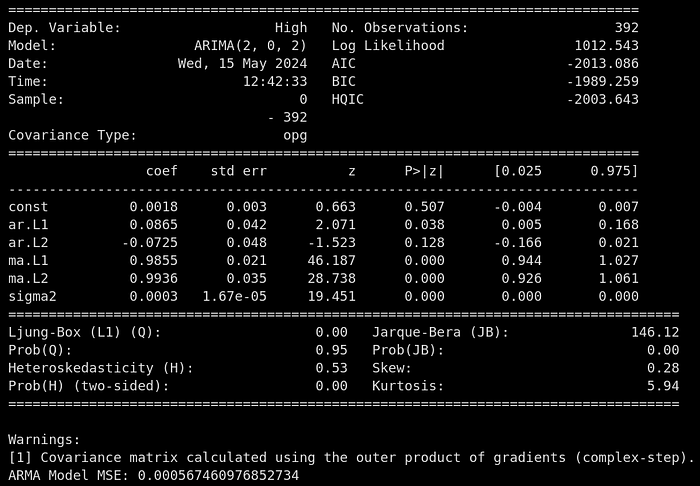

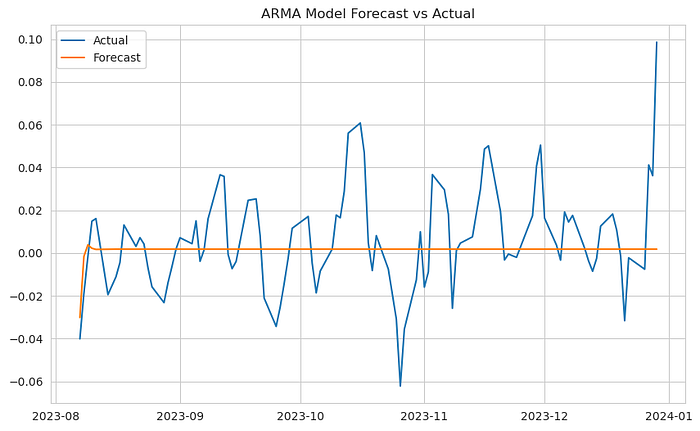

arma_model = ARIMA(train.dropna(), order=(2,0,2)).fit()

arma_forecast = arma_model.predict(start=len(train), end=len(train)+len(test)-1)

print(arma_model.summary())

print('ARMA Model MSE:', mean_squared_error(test, arma_forecast))

plot_forecast(test, arma_forecast, 'ARMA Model')

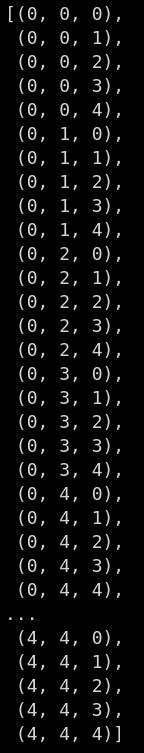

import itertools

p=d=q=range(0,5)

pdq = list(itertools.product(p,d,q))

pdq

import warnings

warnings.filterwarnings('ignore')

lst = []

train_original = df_log_diff[:train_size]

test_original = df_log_diff[train_size:]

for param in pdq:

try:

model_arima = ARIMA(train_original,order=param,seasonal_order=(1,1,1,12))

model_arima_fit = model_arima.fit()

arima_forecast = model_arima_fit.predict(start=len(train_original), end=len(train_original)+len(test_original)-1, typ='levels')

mse = mean_squared_error(test_original, arima_forecast)

print('ARIMA Model MSE(',param,'):', mse)

lst.append(mse)

except:

continue

# executing for all combinations

train_original = df_log_diff[:train_size]

test_original = df_log_diff[train_size:]

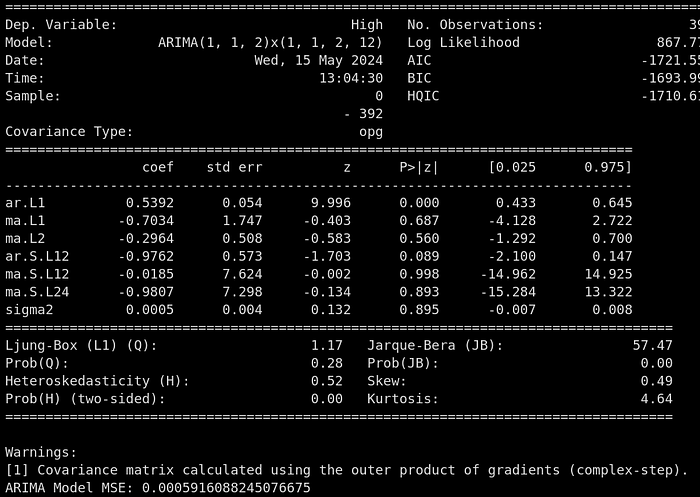

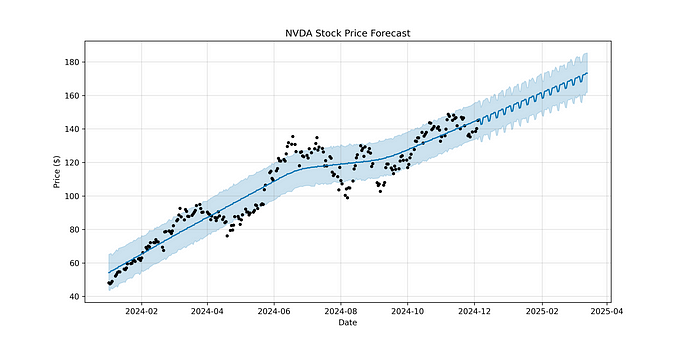

arima_model = ARIMA(train_original, order=(1,1,2),seasonal_order=(1,1,2,12)).fit()

arima_forecast = arima_model.predict(start=len(train_original), end=len(train_original)+len(test_original)-1, typ='levels')

print(arima_model.summary())

print('ARIMA Model MSE:', mean_squared_error(test_original, arima_forecast))

plot_forecast(test_original, arima_forecast, 'ARIMA Model')